Factset Research Report: S&P 500 to Break 6,600 Points in 2025, Analysts Optimistic About Next Year's Profit Growth Outlook

2024/12/22

Article Source: Factset

Conclusions:

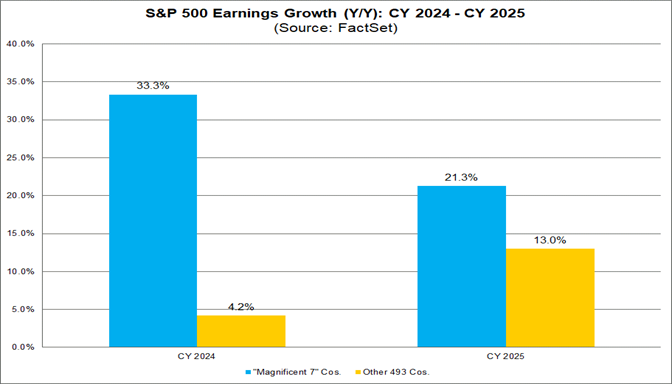

1. S&P 500 earnings will achieve double-digit growth in 2025. Companies "outside of M7" will see significant earnings growth improvement in 2025, with 13% earnings growth.

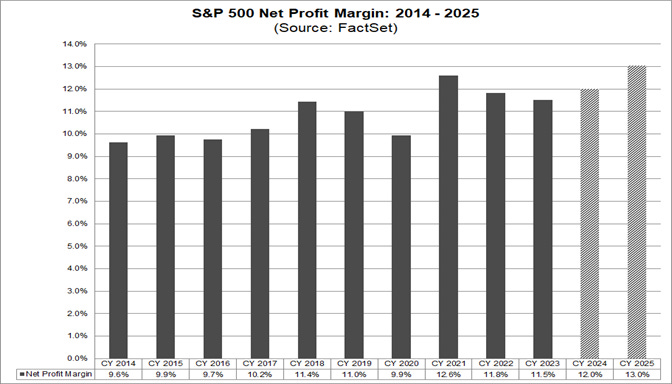

2. 2025 net profit margin is estimated at 13.0%, higher than the 10-year average (annual) net profit margin of 10.8% (highest annual net profit margin reported for the index since 2008).

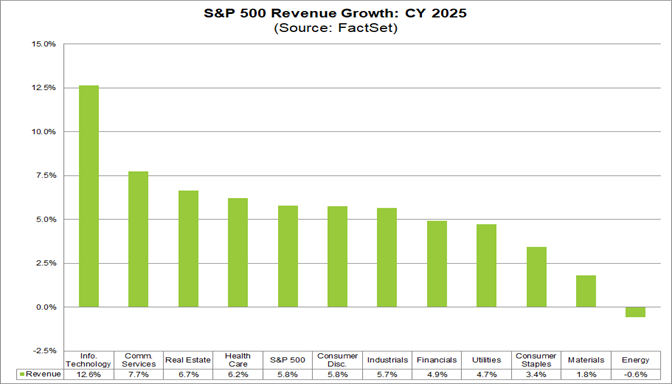

3. 10 out of 11 sectors will see year-over-year revenue growth, led by the Information Technology sector. Two other sectors (Finance and Utilities) estimate 9.0% annual profit growth, while Energy is the only sector estimating an annual profit decline.

4. Industry analysts overall predict S&P 500 index closing price will reach 6,678.18 points after 12 months.

5. If applying the average 6.9% overestimation to current bottom-up target price estimates, the expected closing level at the end of 2025 will be 6,215.94.

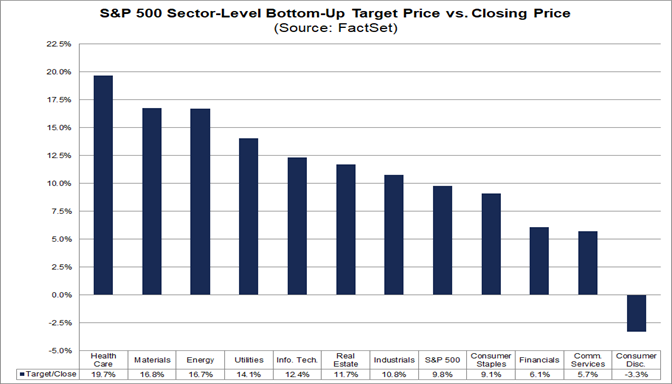

6. Healthcare (+19.7%), Materials (+16.8%), and Energy (+16.7%) sectors estimate the largest price increases, as these sectors have the largest potential upside from the bottom.

7. Consumer Discretionary (-3.3%) sector estimates the largest price decline, as this sector has the largest potential downside between target price and closing price.

Report 1: S&P 500 2025 Earnings Forecast: Analysts Estimate 15% Earnings Growth

Report Source:

https://insight.factset.com/sp-500-cy-2025-earnings-preview-analysts-expect-earnings-growth-of-15

Key Summary:

1. S&P 500 earnings will achieve double-digit growth in 2025. Companies "outside of M7" will see significant earnings growth improvement in 2025, with 13% earnings growth.

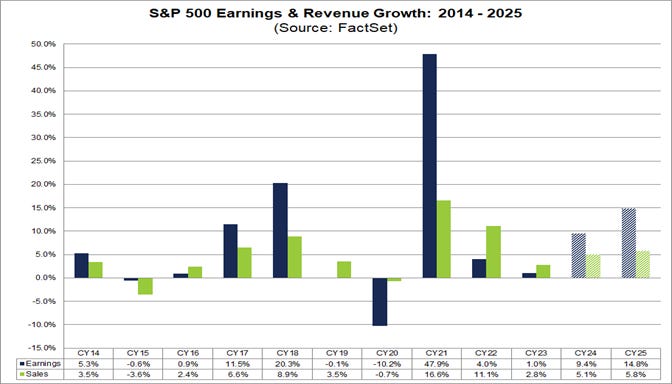

2. Estimated 2025 (year-over-year) revenue growth rate is 5.8%, higher than the past 10-year average (annual) revenue growth rate of 5.1%.

3. 10 out of 11 sectors will see year-over-year revenue growth, led by the Information Technology sector. Two other sectors (Finance and Utilities) estimate 9.0% annual profit growth, while Energy is the only sector estimating an annual profit decline.

4. 2025 net profit margin is estimated at 13.0%, higher than the 10-year average (annual) net profit margin of 10.8% (highest annual net profit margin reported for the index since FactSet began tracking this metric in 2008).

Report 2: Analysts Predict S&P 500 Will Close Above 6,600 Points in 2025

Report Source:

https://insight.factset.com/industry-analysts-predict-the-sp-500-will-close-above-6600-in-2025

Key Summary:

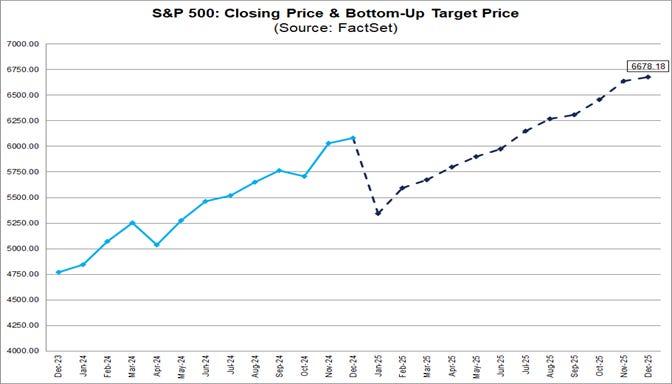

1. Analysts predict S&P 500 index closing price will reach 6,678.18 points after 12 months. The index's bottom-up target price is calculated by aggregating the median target price estimates of all companies in the index (based on company-level target prices submitted by industry analysts).

2. Healthcare (+19.7%), Materials (+16.8%), and Energy (+16.7%) sectors estimate the largest price increases, as these sectors have the largest potential upside from the bottom.

3. Consumer Discretionary (-3.3%) sector estimates the largest price decline, as this sector has the largest potential downside between target price and closing price.

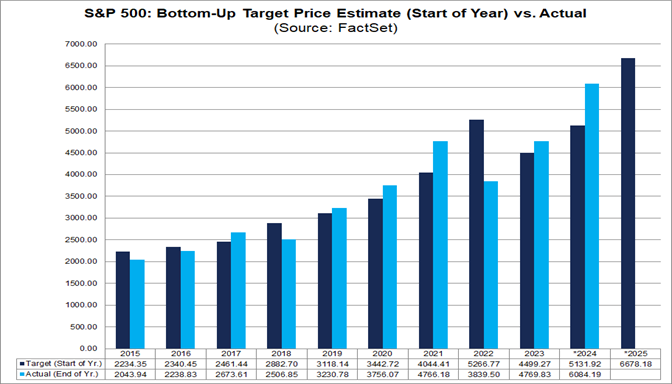

How accurate are bottom-up target prices at the beginning of the year? Industry analysts have historically overestimated the index's year-end closing price.

4. Over the past 20 years (2004 to 2023), the average difference between target price estimates and the index's final price for that year was 6.9%. In other words, analysts overestimated the final S&P 500 level by approximately 6.9% on average when predicting one year ahead over the past 20 years.

5. Analysts underestimated the S&P 500's final level in four out of the past five years (2019 to 2023).

6. If applying the average 6.9% overestimation to current bottom-up target price estimates, the expected closing level at the end of 2025 will be 6,215.94.